In the ever-evolving landscape of finance, the emergence of mobile banking has transformed the way individuals manage their money. Gone are the days of long queues at the bank, cumbersome paperwork, and limited access to account information. With the rise of smartphones and mobile applications, financial institutions have adapted to meet the demands of a digital-savvy generation, ushering in an era of convenience and accessibility like never before.

mobile banking represents a paradigm shift in the way individuals interact with their finances. With its unparalleled convenience, enhanced security, and potential for financial inclusion, mobile banking has emerged as a powerful tool for empowering individuals and reshaping the future of finance. As technology continues to advance, the possibilities for mobile banking are limitless, promising a future where managing finances is simpler, safer, and more accessible than ever before.

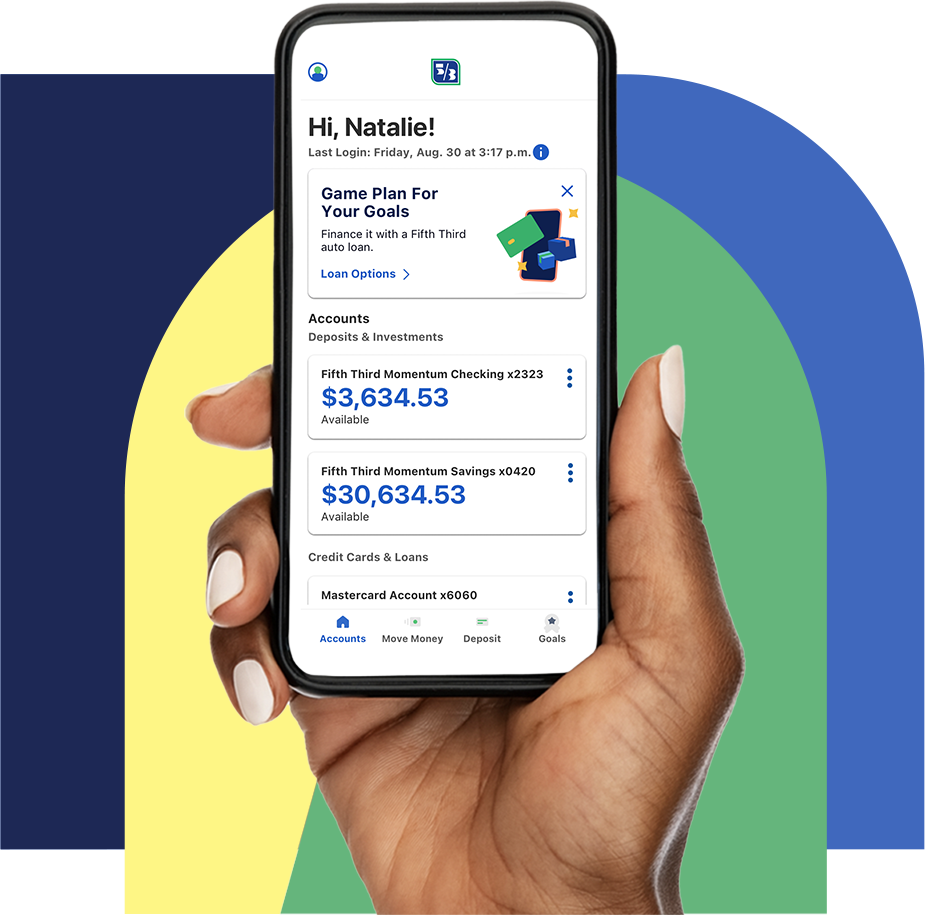

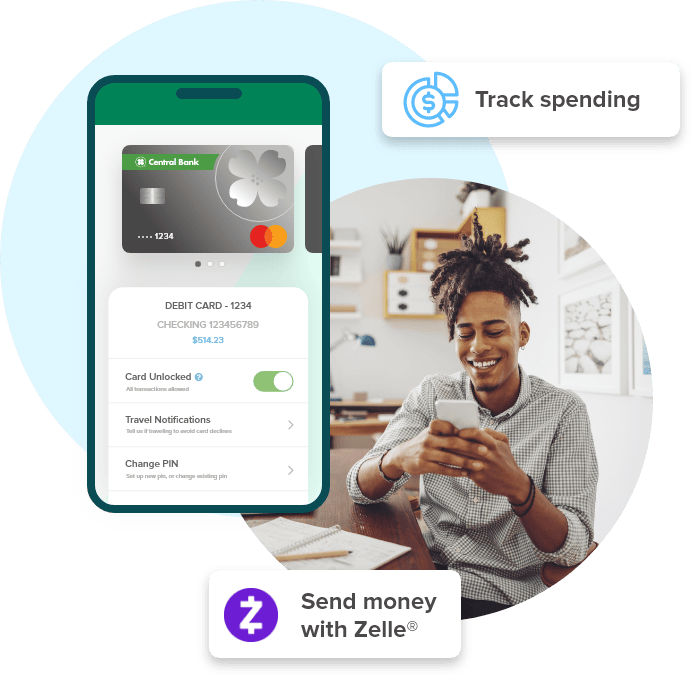

Mobile banking puts the power of financial management directly into the hands of users, allowing them to conduct various transactions and access account information anytime, anywhere.

While convenience is paramount, security remains a top priority in the realm of mobile banking. Financial institutions have implemented robust security measures to protect users' sensitive information and prevent unauthorized access to accounts.

Mobile banking has played a significant role in promoting financial inclusion by breaking down barriers to access financial services. In regions where traditional banking infrastructure is limited, mobile phones serve as a gateway to essential banking services, allowing individuals to participate in the formal financial system.

Start conquering the heights of your business career with our platform. Join the community of more than +5000 successful businesses.

Get Started